A couple of years ago, we conducted an ETF and mutual fund marketing webinar on content ideation and optimization with Arro Financial Communication, one of our agency partners. We’ve revisited the insights discussed and have found that most of the tenets have held through even with the changes brought by the pandemic in the digital world.

In this article, we’ve summarized the hour-long session to bring you the main points of that amazing conversation with Alexandra Levis, President of Arro.

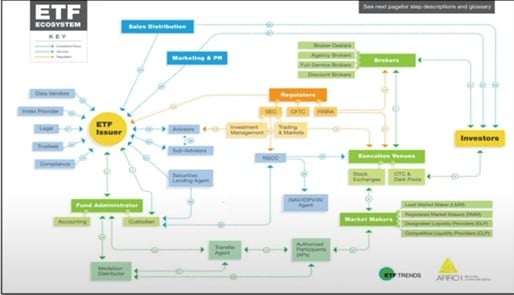

In 2021 alone, there were 8,887 mutual funds in the US and nearly half of the households in the country already own a mutual fund. By the end of the year, there were over 2,690 exchange-traded funds as well. (Number of investment funds in the U.S. 2000-2021, by type Published by Statista Research Department, Nov 28, 2022.) Just from that, you can see how difficult it can be for fund marketers to cut through the noise and get their products recognized.

However, we can’t let that intimidating mountain of a challenge stop us from creating content and converting it to AUM. Let’s go through the steps to create and optimize your content for maximum reach.

Step 1: Idea Generation

One of the main challenges when it comes to content is how to actually start. Naturally, the first step will be idea generation and identifying what type of content you want to put out based on your niche.

In a time when consumers can have all the information they need on the internet, content ideation revolves around 3 main concepts:

- Be on trend or on topic

- Prioritize relevant keywords

- Know your audience and their challenges

Should I be on trend or on topic?

Being on topic is basically taking a talking point and expanding on it using a blog article, video, LinkedIn post, or whatever channel you’re using. These are usually timeless themes that will always exist in your industry or niche. That’s because they are foundational information or they have been accepted as the standard for many years. Examples include the Fed, jobs or earnings reports, interest rates, broad indices commentary and international trade and affairs. What about bank failures? On topic or on trend? Let’s see in our next section.

Being on topic is basically taking a talking point and expanding on it using a blog article, video, LinkedIn post, or whatever channel you’re using. These are usually timeless themes that will always exist in your industry or niche. That’s because they are foundational information or they have been accepted as the standard for many years. Examples include the Fed, jobs or earnings reports, interest rates, broad indices commentary and international trade and affairs. What about bank failures? On topic or on trend? Let’s see in our next section.

Being on trend, on the other hand, is a more complex case since content creators are always trying to produce “the next big thing”. Of course, this is still perfectly achievable and one way to approach this is to look at the news cycleyour company, products, and services can speak to. So, it could be bank failures if there has been a recent event. Another such trend could be ESG or responsible investing and the list goes on and on, just as the news cycle goes. More than anything, people don’t want to be spoon-fed information about your mutual fund or ETF, for example. Your competition is likely already doing that and if you want to cut through the noise, don’t take potential clients through that experience again. Make them think, contextually, about how this product will be a timely solution to what’s currently happening around them.

Importance of relevant keywords

The initial thinking is that keywords can only work in long-form written content like blog articles because that’s where you can put as many of them as possible.

That’s inevitably a false assumption because using relevant keywords even in short descriptions in videos or podcast episodes can be just as effective in maximizing reach. Even the right headlines and titles for YouTube Shorts and videos, LinkedIn posts, and Tweets, can make a huge difference.

Knowing your audience

Last, and definitely the most important, is to understand your audience and their challenges. Even if it’s not an entirely new solution in the market, if you can effectively relay how your product or service can solve or ease their problems, they will watch your video, read your article, or interact with you on social media.

Last, and definitely the most important, is to understand your audience and their challenges. Even if it’s not an entirely new solution in the market, if you can effectively relay how your product or service can solve or ease their problems, they will watch your video, read your article, or interact with you on social media.

When it comes to financial marketing, there are three main groups of target audiences based on sophistication level.

- Institutions

- Financial Intermediaries

- Retail

Institutions are the most sophisticated. Avoid the fluff at all costs. This audience is seeking the main drivers and the research to back it up. Of course, institutions are people too, so it is important to engage them and contextually meet them where they are. Are they considering a change to their model portfolio? Well then in order to help these decision makers, you’ll need to address their issues (low or unexpected returns, for instance), then help them make the case through studies and macro- and micro- economic research.

Often the most demand for content comes from financial intermediaries. They have many needs. It could be to build their practices, update existing clients, stay on top of everything that is going on in markets and find the best solutions for their clients. This audience will also include the home office decision-makers at the wirehouses, registered investment advisors, independent broker-dealers, and broker-dealers. Even then, it’s also important to split these up because some of them have discretion and others don’t. So depending on whether or not those intermediaries need to communicate ideas with their end clients, will determine the tone you’ll be using for your content.

Lastly, with retail clients, you never want to assume that everybody has a degree in finance or is as knowledgeable as the experts. Knowing this, you can simplify and distill those topics to help your audience with their first step.

Step 2: Topics and Styles

Once you’ve established the general topic and the audience you want to reach, it’s time to plan on the medium that you want your audience to consume the information in.

The thing is, not everybody wants to read a long white paper. You’ll have audiences that prefer to watch a video, read a tweet, or even get an email blast. That’s why it’s important to diversify your content formats.

Selecting Content Formats

Today, it’s considered more advantageous to leverage video and shorter content to keep up with the fast-paced nature of the internet. However, that doesn’t mean that you should disregard long-form pieces like blog articles and white papers.

- White Papers – A report on complex issues that also presents the issuing body’s insights on the topic. Great for establishing authority, especially if establishing yourself as a thought leader in your niche.

- Animated videos – Entertaining, concise, and often lay down the important details as quickly as possible. This is made for the busy, on-the-go individual and has a viral aspect that written content just doesn’t have.

- One pager – Can be either graphic or text-heavy depending on what is being presented. A one pager is great for distilling information and quickly demonstrating a business or product overview.

- Tear sheet – Every ETF or mutual fund market will be familiar with tear sheets. This is a great way to present facts and figures and help tell the performance story of your product monthly or quarterly.

- Infographics – In financial services, infographics are probably the best way to tell a story using data or data visualization. They are a great way to break down complex investing processes and present ideas in a digestible way.

- Blog pieces – These have the most frequency because they are a great way to go in-depth on specific topics while also being a constant reason for people to keep coming back to your site.

Selecting Content Styles

Aside from the form that you produce your content in, you should also think about how it’s going to be presented. Generally, most content can be either educational or product-specific.

Educational pieces will have a longer shelf life. The biggest advantage is that they can be repurposed multiple times so you can reliably produce content in multiple mediums. If you have a blog article, for example, you can easily take the key points and turn them into a Twitter thread or LinkedIn post.

Product-specific pieces, on the other hand, will be the main way to keep people interested in individual products and drum up your AUM. In this case, it won’t be about the different characteristics of your product anymore but more about how it’s a solution to their problem.

Step 3: Content Production Frequency

Another reason why you should consider the best format for your current situation is that it will dictate the timing and frequency of your content production. More than anything, this will be about balancing how quickly your audience can consume the information and how your team can produce that content.

- Daily – Social media posting should be your go-to if you plan on having daily content. It’s an easy way to stay connected with your audience and also stay updated on current trends and news.

- Weekly – Blog articles are a great tool if you want to release content weekly because they’re shorter than white papers but still go in-depth on certain topics. Again, they are also a great way to keep people coming back to your site.

For content produced on a monthly or quarterly frequency, these are the ones where you should think more about the capacity of your own team. You have to make sure that what they produce is still manageable. That’s so you can stay consistent and provide the most value for your audience even when it’s not done as frequently as a daily or weekly posting.

So content produced monthly can include newsletters or email blasts while white papers or infographics can be released on a quarterly or semesterly basis. These typically take more time to create because of the data and insights they present.

Step 4: Timing

Utilize a content calendar

The best way to plan effectively is to create a content calendar that you can look at for five months ahead at most. This serves as your main reference for scheduling your content and is also a place for you to track changes in your production.

This will help you adjust to market changes very easily and show your clients that you are paying attention to what’s happening in the world. In case something new comes out, for example, you won’t have to scramble around your teams and rush them into making new content or changing what’s already published.

Step 5: Search Engine Optimization (SEO) For Your ETF or Financial Service Content

Now that we’ve created great content, let’s talk about how to maximize exposure and gain long-term success from the content we’ve just produced. One of the most reliable and efficient ways to do that is through SEO.

When it comes to written content specifically, it’s ideal to run the piece through SEO before it goes live. Why? Well, one big reason is you can add relevant keywords to spots that search engines value highly. At Zero Company, for example, we typically have the content sent to us for review, and optimizations are made prior to going to compliance so all the tweaks are done in the middle of the process and everything is streamlined.

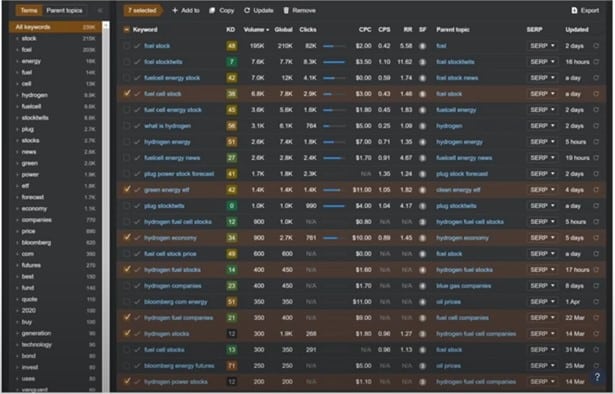

Prior to the content being created, you can already utilize SEO as well. You can do keyword research so that you can direct what keyword best fits what you want to talk about. So the content can be created specifically just to rank on that keyword.

Once you’ve created your content though, SEO can impact key aspects on and off-site including:

- Title Tags

- Content Value/Length

- Site Performance

Every keyword has its own difficulty and some will naturally be considered more valuable than others depending on the topic focus. SEO tools will also show data on volume, estimated cost per click, and a variety of other metrics that help businesses determine the best opportunities available for them.

Utilize a content calendar

The best way to plan effectively is to create a content calendar that you can look at for five months ahead at most. This serves as your main reference for scheduling your content and is also a place for you to track changes in your production.

This will help you adjust to market changes very easily and show your clients that you are paying attention to what’s happening in the world. In case something new comes out, for example, you won’t have to scramble around your teams and rush them into making new content or changing what’s already published.

Step 6: Distribution

Once you’ve checked your content through SEO, you’re going to naturally think about how to distribute it next. Connecting directly to search engine marketing, it’s common to look at paid search and similar avenues.

Paid Search For Your ETFs, Mutual Funds or Financial Market Content

Looking at it transparently, launching new content without the right tools will take you a long time to rank. If you’re launching a new fund, for example, and you need momentum, pay-per-click (PPC) advertising can be a nice start.

Depending on how competitive the keyword is, organic growth can take months and this is where paid search comes in. You can pay to play and put your product on top of the search engines any time someone is searching a keyword.

Mutual Fund and ETF Programmatic Ads

Programmatic advertising is another tool you should definitely have in your digital marketing toolbox. Although you most likely will need to work with an agency to access the platform, it’s a great tool to use for media buying and native ads.

Basically, you have a piece of content that you can run with an ad of similar content to drive traffic. You can run these ads as typical banners, native ads and video. The most unique advantage of programmatic, however, is that you can also connect to smart TVs to have ads appear on Roku or Hulu subscriptions and the like. Let’s say you show the person a native ad and they see your content so they go to your site. You can now follow it up with a CTV ad specifically on their smart TV. Instead of ads trying to hit all households on a specific channel, programmatic allows you to target a specific individual.

It is also very flexible in building audiences. Let’s say you want to target retail audiences of those who downloaded the Robinhood app. This is an option on programmatic.

YouTube Advertising for Investment Managers

Leveraging video is almost a necessity in today’s world as well. One of, if not the best place to do that, is through YouTube. If you can show someone a video on your ETF for two to six cents per view, there’s tremendous value there already.

Leveraging video is almost a necessity in today’s world as well. One of, if not the best place to do that, is through YouTube. If you can show someone a video on your ETF for two to six cents per view, there’s tremendous value there already.

You could have a five-minute video explaining your product and you’ll likely only be paying eight cents for each person that watches the full length of the video. So you’ve provided value while still increasing your reach in a cost-efficient way.

Of course, targeting is even more important here. You have to make sure you target the right audience otherwise you’ll be paying six cents, for example, only for a person to finish 25% of the video.

Creating and optimizing content brings tremendous value not only to promote your products or services but also to highlight your brand. It’s essential to keep in mind, however, that you can’t just pump out as much content as possible. You have to optimize it so that you can cut through the noise and reap the rewards of your ideas and creativity.

But if you have no idea how PPC works or your SEO strategy hasn’t been effective, take your first step with Zero Company Performance Marketing and we’ll start optimizing your investment and financial services content instantly.

Check out the full webinar to learn the full details about content ideation, production, search engine optimization, and more.